Car Finance Experts Q & A

If you have any questions, our friendly experts will help you find the right answers. Just click the button, fill in the form and we will contact you shortly.

Have a question? Ask our experts now >We have an extensive range of different lenders and the majority are happy to lend to self-employed applicants – depending on the lender they may or may not require you to prove your income – since we started helping people obtain Car Finance in 1988, we have sourced finance for thousands of self-employed people. Send your details through to us, and we’ll make sure we get the right deal for you and your circumstances

At motorfinance 4u, we have a large panel of lenders who consider a wide variety of credit profiles and scenarios. From what you’ve said regarding your credit it’s certainly possible we could help. In terms of what deals we could get for you, this is not possible for us to say without an application from you – if you apply to us via our simple online form, one of our experienced advisors will be happy to discuss the best deals we can get for you, and give you detailed help on how to improve your credit score

No finance is guaranteed, and if you do find any companies that say they guarantee car finance, it’s simply not true, and you certainly shouldn’t pay any fees. At motorfinance 4u we would never charge you for anything we do, and although we cannot “Guarantee” that we get finance approved for you, we can guarantee that we will consider each application individually, and will work hard to achieve the best deal possible for you

It’s not as easy as a case of switching finance companies – you would need to settle your existing loan with Black Horse and take out a new one – at motorfinance 4u, we do have a personal loan lender, who may be able to assist with this – just fill in our simple application form and we’ll be in touch

Certainly, although you have only recently taken out the loan with Creation, and will probably have some negative equity (where your old car is not worth the amount left to be paid on your previous loan), we have a number of finance companies who could still potentially help – they specialise in helping customers in this situation.

If you are currently out of work, and with poor credit, it is very difficult to get car finance – however, if you have a friend or relative who is working, who would be prepared to help you by entering into a finance agreement jointly with yourself, it certainly is possible. This is called a guarantor loan, and it means that your friend or relative agrees to pay the loan if you’re unable to. If you make the payments yourself, then it’s a good way to build up your credit rating from the floor.

Give us a call and speak to one of our specialist car finance advisors and we’ll help you through the application process.

It is possible to have more than one car on finance, and the car loan you have through Tesco will be shown on your credit file as a personal loan, rather than hire purchase, which is the traditional form of car finance, meaning it would be easier to finance a second vehicle. In terms of criteria, it depends on which company we would use to get you the best finance deal – this is dependent on your overall credit profile.

Get in contact and talk to one of our specialist car finance advisors. They will be able to talk to you in more detail and make sure that financing a second vehicle is a viable option for you and get you the best deal.

If your credit score is “not-so-great” then you should avoid applying for finance through high street lenders like NatWest. Their calculator is designed to encourage you to apply, but unlike us here at motor finance 4u, they may not be able to offer people with low credit scores car finance. Their lending criteria tend to be much stricter than the specialist motor finance companies that we have access to.

Of course, you know that multiple credit searches can adversely affect your credit rating. This is why it is beneficial to apply for car finance through a broker like us, because with one application you have access to multiple finance companies, giving you a better chance of arranging a loan successfully.

Send your application to us, and we will work as quickly as possible to get you into a new car, ensuring that your details are only sent to the most suitable lenders, where we are most likely to gain an acceptance.

Not being on the Electoral Roll and having a poor credit score does not automatically exclude you from obtaining car finance, particularly if you apply through motor finance 4u. We have access to numerous finance companies who specialise in helping people with less than perfect credit profiles, and our highly-skilled team of advisors will work hard to find you the most suitable deal.

Make sure that you apply with us and you could be on your way to a new car in no time at all.

As with any car finance agreement, you are entitled to settle the finance at any time. As you have less than a year to go on your current agreement with Barclays, you will more than likely be in a position where you have equity on your previous car to use as a deposit for your new one (this is where the amount you have to pay to settle off your old finance agreement is less than what your car is worth, leaving you with money left over). If you’ve maintained and kept up all your monthly repayments on time with Barclays bank, this will help your credit score and enable us to get you the best possible rates of interest for your next car.

Apply with us and we’ll do our best to help you get out of your current finance agreement and into an agreement for a bigger car.

This is a very good idea. If you decide to take out a car loan through ourselves, you will still have the bank to fall back on should you need them in the future. You may even have a better chance of arranging car finance with us than with the bank because we work with a number of different car finance companies. Please complete our short application form online or call us to complete your application and we will be able to talk with you in more detail about which of our finance offerings would be suitable for you.

Yes we specialise in arranging loans for used cars which you can buy from any authorised car dealer.

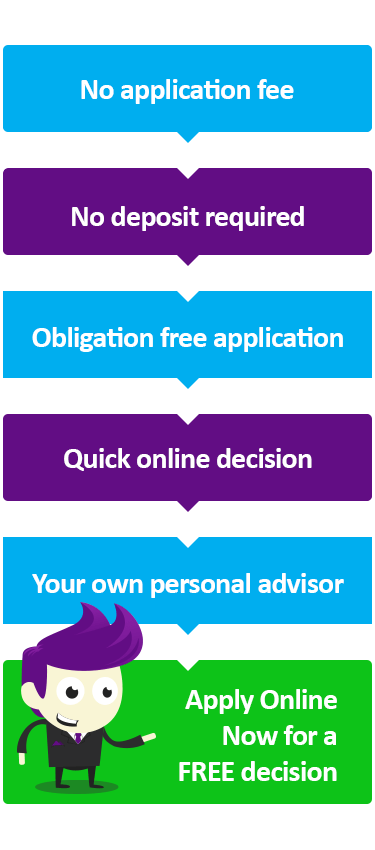

All we need is an application and then you’ll be free to find your perfect car from any reputable dealer. Simply complete the online application which is totally free and you are under no obligation.

We certainly can Michelle. We work with a selection of car loan companies and will be able to find a package tailor made to suit your personal circumstances, and with no deposit. Please apply using our quick and easy online application, it’s free and you are under no obligation.

Of course we can. At motorfinance 4u that’s exactly what we do. We have a vast range of lenders, so finding the right car finance package to suit you is no problem.

If you send us details of the car you wish to buy and complete an online application, we’ll be able to get you on the road in no time.

Hi Stacey, the answer is probably yes. It will depend on your income and other circumstances. If you apply online now, it’s free to apply, one of our friendly car loan advisors will contact you to discuss your options.

Hi Laura, congrats on saving up a deposit, that will definitely help you. Some of our lenders can help people of your age. Have you used any other types of finance, like a loan or credit card? It might help if you have a guarantor on your finance. If you need more information about this you can arrange to speak to one of our advisors on 01892 822000 or apply online and we will see what we can do for you.

Hi Richard, that’s a good question. We can arrange loans from £2000 to £50,000 and even more if needs be. The amount we will be able to get approved depends on your own personal circumstances and credit score and of course your income. The best way forward is to apply using our simple online application, it’s free, and one of our advisors will be in touch shortly to talk through your options. It’s a very good idea to get your loan approved first, as it puts you in control of your car purchase.

We can arrange a Hire Purchase car loan for you between 1 and 5 years or a PCP (personal contract purchase) which is like hire purchase with a balloon payment at the end. If you let us know how much you want to borrow and how much you can afford each month we can work out the shortest period you could borrow it over.

If you complete an online application, once approved you’ll be able to buy the car of your dreams.

Thanks for your enquiry Phil, that’s no problem, we have a number of loan companies that will consider a second loan and at very competitive rates. Why not apply online now, it’s free and one of our specialist car loan advisors will contact you shortly

We can! motorfinance 4u is one of the longest established car finance companies in the UK and so have numerous financing options to suit almost all circumstances.

If you fill in the short online application form we can get you pre-approved so you can start shopping for your next car.

Hi Robert, we cannot guarantee car finance, however we can guarantee that we will do our best to get a car loan approved for you. We have several lenders that will offer car credit to customers with bad credit history. So it’s best to apply online, it’s free and easy, and one of our advisors will be in touch very soon.

Kind regards

As long as the car is under 11 years old at the end of the agreement that’s no problem. In fact we do have options to finance slightly older cars.

Send us over car details and complete an online application so we can arrange this purchase for you.

Hi Thomas, making sure that you get the most competitive finance deal available to you can be confusing. Banks advertise very low rates but won’t actually give it to many people that apply. So your experience is not uncommon.

Their adverts are supposed to catch your attention and then it will either be unavailable or they offer you a different rate, so the only way of really knowing what is available to you is to apply and see what you are offered.

APRs are confusing as they can be calculated differently from one lender to another. The best way to check the cost is to compare the monthly payments.

If you try our loan calculator it will give you an indication of payment depending on your credit history. In the current financial climate a rate below 10% is very competitive.

You can either give one of our advisors a call for further advice on 01892 822000 or complete our online application and we will get back to you with a decision.

Yes we should be able to help you. Banks and most other loan companies have quite strict criteria which include having to be in employment for at least 6 months which is not a lot of help to people like yourself who are trying to get back on the career path. If you are unemployed and need car finance the options are more limited but at motorfinance 4u we have a some options to help you and in so doing help to rebuild your credit history. A Guarantor Loan maybe the best option for you.

It is very quick and easy and we can usually get you the money the same day putting you in a strong position as a cash buyer to purchase a car. You can apply for unemployed car finance online or you can phone one of our experienced and friendly advisors who will take your application over the phone. They will also need to talk to your guarantor so have their name, address, date of birth and phone number handy. Hope this is of help.

When it comes to car finance, new drivers and learners often struggle - as most lenders feel safer providing finance to experienced drivers. However, at motorfinance 4u, we work with a number of lenders willing to provide new drivers with car finance - although the final decision would rest with them.

Either call us on 01892 822000 - or alternatively you can apply online.

Of course, we understand it is often difficult to borrow money for the first time. Some companies avoid selling young driver car finance as they believe it’s a risk – but we believe in trying to help everyone, so we’ll do our best to find a finance deal for you. Are you currently employed and in possession of a valid driving licence? If so, we should be able to sort you out with a suitable loan for you.

Please call us on 01892 82200 or apply online. Applications are totally free and you’re under no obligation.

It can be very frustrating when you can’t get car credit, but with our flexible lending options we aim to help everyone – no matter what your circumstances. If you’ve got a valid driving licence and you’re currently employed, our independent lenders are unlikely to refuse you credit. If you need a car but can’t get credit, give us a call on 01892 822000 or simply apply online and we’ll get the ball rolling.

This is a great question. People often ask if they’re eligible for car finance – but the better question is: how easy is it to get car finance? With motorfinance 4u, you don’t need to worry about deposits or bad credit history. We are experts in helping people to obtain a car loan. Our friendly team are on hand to discuss you options whatever your budget. You can call us on 01892 822000 to discuss your options, or if you prefer, apply online with our easy to use online application form.

Hi. We get asked these questions a lot. The good news you don’t need much. As long as you’re employed and can afford the payments, we should be able to secure a finance deal that meets your needs. As for documents, if you have a valid driving licence, it should be no problem.

If you’d like to know more, fill in our online application form or call us today on 01892 822000.

Whenever you make such a big investment, you need to do your research so that you have control of your budget. Here at motorfinance 4u, we’ll do this research on your behalf. We work with a large, diverse panel of lenders which means we have access to over 80 products, one of which is sure to be right for you. We have the ability to determine very quickly the most suitable product to suit your individual circumstances, which means you are in full control when you search for your next car.

Hi Steve, rest assured we're not like a payday lender. If we give you a finance offer you will have plenty of time to look at the rates and compare them to other places, and in general our APRs are very competitive. We do in fact work with banks such as Santander, and we have exclusive products with lenders which aren't available on the high street, so it's worth applying with us to see what we can offer you. If you would like to know more fill in our simple on line application form or give us a call on 01892 822000 Applications are totally free and you’re under no obligation.

Of course you can Graham. We might need to see proof of income for the last three months, but in most cases being self-employed isn’t a problem. Fill in our online application form and we’ll have a loan approved for you in no time.

Hi Georgina, we do a lot of refinances and they're generally quite simple. Just fill in the online application form or call us on 01892 822000 for more advice.

Hi Graham, yes that's fine. Unlike other car finance companies we don't sell cars, so you have more freedom about where to buy from. Your local dealership should be fine, just give the details to your personal advisor and they'll check it out and do the rest.

No problem at all Emma. There are a lot of customers with no deposit, and the good news is that we are able to arrange car finance for most customers, without the need for a deposit and we will do our best to help you get in to a car as soon as we can, possibly within 24 hours.

Hi Jack, yes we arrange a lot of van finance. We have several different loan companies who provide loans for commercial vehicles and motorbikes too. You can either apply online using our simple application form or call us on 01892 822000.

Hi Dan, from what you have said we certainly should be able to arrange a £7000 loan for you. motorfinance 4u do not charge a fee for our service and we can usually help you to get into your new car within 3 days. The best way forward is to submit an online application, there is no obligation on your part, and you can talk it through with one of our friendly team before you make a decision.

Hi Bruce, We do have several finance companies who will consider applications from people currently serving in the forces, it helps if you have a UK residential address and not just a permanent barracks address. If you would like to complete an online application, we’ll be happy to investigate the best options available to you.

We certainly can, and we would be delighted to help. Is the Focus ST new or second hand? Either way we are here to help you finance your new car and hope to have you on the road as soon as possible.

Feel free to call us on 01892 822000 or complete our short online application.

We work with a wide range of lenders so have car finance options available for a wide variety of customers and vehicle type.

If you are looking to buy your car from a dealer we would be able to offer you either a hire purchase or PCP agreement.

Give us a call on 01892 822000 or complete our short online application and we’ll hope to have you on the road in no time.

You’ve come to the right place Lisa as here at motorfinance 4u we work with a wide range of lenders, so finding the right car finance package to suit you and the car you are looking to buy is as easy as 123.

If you complete an online application, we’ll be able to get things arranged without delay.

Of course. Self-employed customers are no problem to us. Having not borrowed much money in the past occasionally causes a problem but we’d be more than happy to discuss the options with you.

Please call us on 01892 822000 or complete the online application and we’ll be in touch as soon as possible.

No problem. Have you been declined by VW finance or are you simply looking for an alternative? If it’s a new VW have you applied through the dealer as they often have special schemes for brand new cars. If you have been declined by them or the vehicle is second hand we’d be happy to provide help finance your car.

Please complete an online application and we’ll get you approved in no time.

We can arrange a Hire Purchase car loan for you between 1 and 5 years or a PCP (personal contract purchase) which is like hire purchase with a balloon payment at the end. If you let us know how much you want to borrow what an affordable monthly payment would be we can work out the shortest period you could borrow it over.

If you complete an online application and we’ll get you in your new car in no time.

Hi Alan, We receive a lot of applications for customers who have had previous credit problems and therefore a poor or bad credit score. If your financial problems are behind you we have several lenders who will consider your application and we would expect to get car finance approved for you. The amount we can get approved depends on your income, so if you complete our simple, free online application we will have an answer for you very quickly.

No problem, that is not unusual. Please fill in the online application form and we will do our best to get you approved ASAP.

Thanks for your question. Like most people it’s difficult to buy cars with cash outright so nearly all people take out car finance to buy their car. Some lenders refuse finance because of a poor credit history or the driver’s age – but at the motorfinance 4u we don’t think your circumstances should hold you back. At motorfinance 4u we aim to make the whole process as easy as possible, whatever your financial situation.

If you’d like to see how we can help you, give us a call today on 01892 822000 or alternatively, you can apply online

Hi Samantha,

We work with various lenders suited to your particular circumstances and they will be happy to consider your loan favourably.

If you would like to complete an online application, we’ll be happy to investigate the best options available to you. Click the link below or call us on 01892 822000. Applications are totally free and you’re under no obligation.

Best regards

Hi Sue, we have various lenders who might be able to help, depending on your circumstances. If you apply in your name and enter your husband's details as a joint applicant we try our best to get you a positive outcome.

The best way forward is to complete our short online application, or call us on 01892 822000 and we’ll get the ball rolling.

Hi John,

We work with several lenders who will consider your application and so should be able to arrange a suitable loan for you.

If you would like to complete an online application, we’ll be happy to investigate the best options available to you.

Kind regards

Hi Lisa, if you are employed or self-employed, earning over £1000 a month and have a full driving licence then we would have a good chance of arranging a car loan for you. If you complete our online application (it only takes a minute or two) and we will get back to you quickly, and the good news is can choose a car from any reputable car dealer nationwide.

Dear Kate, Thank you for your enquiry. Our interest rates start from 5.9% APR so there is a very good chance that we will be able to save you some money. If you take a look at our online car finance calculator it will give you a very good indication of monthly payment before you apply. We have several different lenders that offer very low rate finance. If you fill out our online application form, we will see what we can do for you. If you have any more questions, please feel free to call us direct. Applications are totally free and you’re under no obligation.

Thank you for your enquiry Oliver. Based on your income we could get you approved for a loan limit of up to £15,000, possibly more if you needed it. If you want a higher amount that will depend on whether you have paid off the debts or are in the process of paying them off. If you apply online we will aim to have an approval for you as soon as possible.

Do you have a question about car finance?

Should you require any further assistance please fill in the form below and we will contact you shortly.

Tags

Natwest Loan CalculatorCar Finance Best DealsGuaranteed Car FinanceBlack Horse FinanceCreation Car FinanceZutoTesco LoansBarclays FinanceUsed Cars FinanceCar Finance Credit ScoresCar LoansCar Finance For New DriversDealership FinanceCar Finance And Good Credit RateCar Loans And Vehicle AgeCar Finance With Low AprCar Finance For UnemployedCar CreditCar FinanceMotor FinanceCar Finance For Self EmployedCar RefinanceCar Finance With No DepositVan FinanceCar Finance FeesCar Finance For Armed ForcesCar Choice On FinanceCar Finance For Poor Credit Real Loans, Real People.

Real Loans, Real People.Get help from one of our

friendly experts today

What our customers say

I just want to say how helpful and friendly all your staff have been, you really have all been a pleasure to deal with and very professional. I can't thank you enough. KR Jessica Townsend

Hi Alex, Thank you very much, I would just like to say you have been fantastic and we really appreciate all you have done to guide us through the process and help. Many Thanks William.

Hi Bradley, That's great. Thank you very much for your help. You've been a pleasure to deal with and I wish you all the best for the future mate. KR Roger