Answers about car finance for poor credit

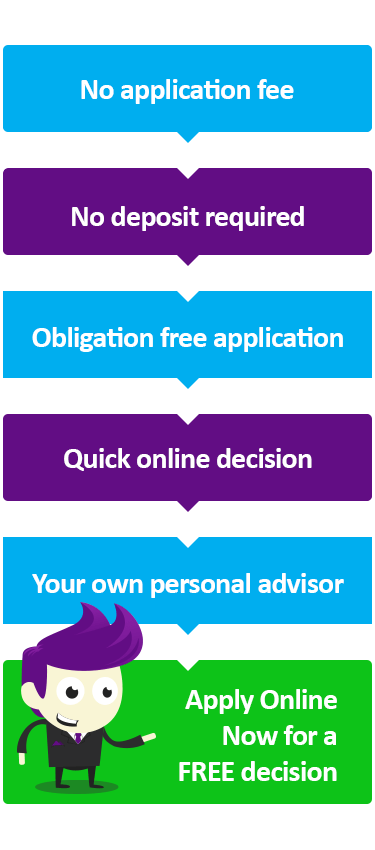

Car Finance can be difficult when you have a poor credit score. But, at Motor Finance 4U we aim to make it as simple and hassle-free as possible. We do this offering your own personal assistant and we expect no application fee or deposit when looking into finance solutions. Alongside car finance, we offer finance on a number of vehicles; vans, caravans, motorbikes and commercial vehicles.

FAQs - Most Frequently Asked Questions

Hi Alan, We receive a lot of applications for customers who have had previous credit problems and therefore a poor or bad credit score. If your financial problems are behind you we have several lenders who will consider your application and we would expect to get car finance approved for you. The amount we can get approved depends on your income, so if you complete our simple, free online application we will have an answer for you very quickly.

No problem, that is not unusual. Please fill in the online application form and we will do our best to get you approved ASAP.

Thanks for your question. Like most people it’s difficult to buy cars with cash outright so nearly all people take out car finance to buy their car. Some lenders refuse finance because of a poor credit history or the driver’s age – but at the motorfinance 4u we don’t think your circumstances should hold you back. At motorfinance 4u we aim to make the whole process as easy as possible, whatever your financial situation.

If you’d like to see how we can help you, give us a call today on 01892 822000 or alternatively, you can apply online

Hi Samantha,

We work with various lenders suited to your particular circumstances and they will be happy to consider your loan favourably.

If you would like to complete an online application, we’ll be happy to investigate the best options available to you. Click the link below or call us on 01892 822000. Applications are totally free and you’re under no obligation.

Best regards

Hi Sue, we have various lenders who might be able to help, depending on your circumstances. If you apply in your name and enter your husband's details as a joint applicant we try our best to get you a positive outcome.

The best way forward is to complete our short online application, or call us on 01892 822000 and we’ll get the ball rolling.

Hi John,

We work with several lenders who will consider your application and so should be able to arrange a suitable loan for you.

If you would like to complete an online application, we’ll be happy to investigate the best options available to you.

Kind regards

Hi Lisa, if you are employed or self-employed, earning over £1000 a month and have a full driving licence then we would have a good chance of arranging a car loan for you. If you complete our online application (it only takes a minute or two) and we will get back to you quickly, and the good news is can choose a car from any reputable car dealer nationwide.

Do you have a question about car finance for poor credit?

Should you require any further assistance please fill in the form below and we will contact you shortly.

Tags

Natwest Loan CalculatorCar Finance Best DealsGuaranteed Car FinanceBlack Horse FinanceCreation Car FinanceZutoTesco LoansBarclays FinanceUsed Cars FinanceCar Finance Credit ScoresCar LoansCar Finance For New DriversDealership FinanceCar Finance And Good Credit RateCar Loans And Vehicle AgeCar Finance With Low AprCar Finance For UnemployedCar CreditCar FinanceMotor FinanceCar Finance For Self EmployedCar RefinanceCar Finance With No DepositVan FinanceCar Finance FeesCar Finance For Armed ForcesCar Choice On FinanceCar Finance For Poor Credit Real Loans, Real People.

Real Loans, Real People.Get help from one of our

friendly experts today

What our customers say

I just want to say how helpful and friendly all your staff have been, you really have all been a pleasure to deal with and very professional. I can't thank you enough. KR Jessica Townsend

Hi Alex, Thank you very much, I would just like to say you have been fantastic and we really appreciate all you have done to guide us through the process and help. Many Thanks William.

Hi Bradley, That's great. Thank you very much for your help. You've been a pleasure to deal with and I wish you all the best for the future mate. KR Roger